Exemplary Tips About How To Avoid A Deficiency Judgement

There are a variety of foreclosure defense strategies available,.

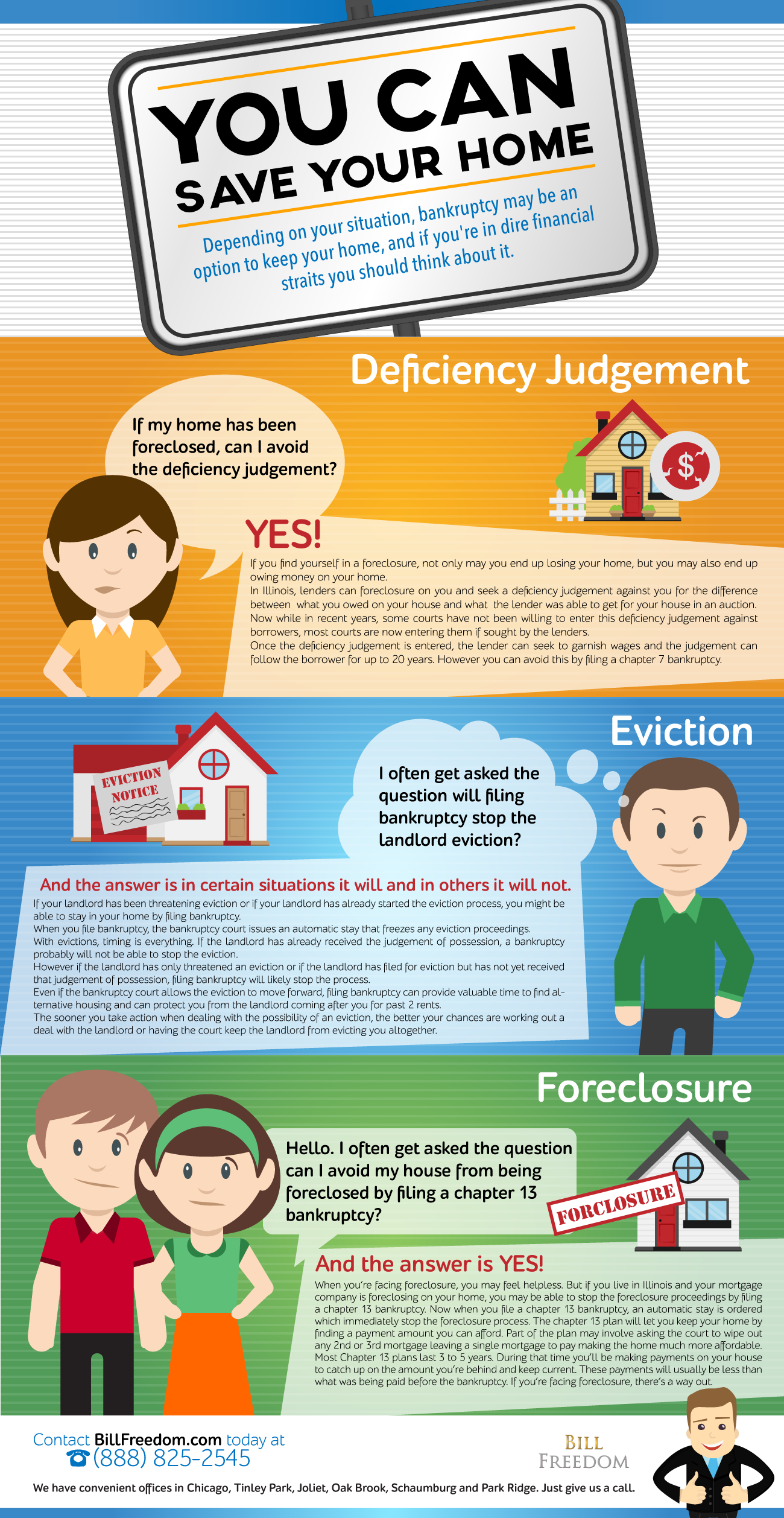

How to avoid a deficiency judgement. Even after a foreclosure, you can still get a call from your mortgage lender claiming that you owe them even more money. I lost my job and took one in a neighboring state at half the pay. Each state’s laws vary on how and when a lender can seek a deficiency judgment.

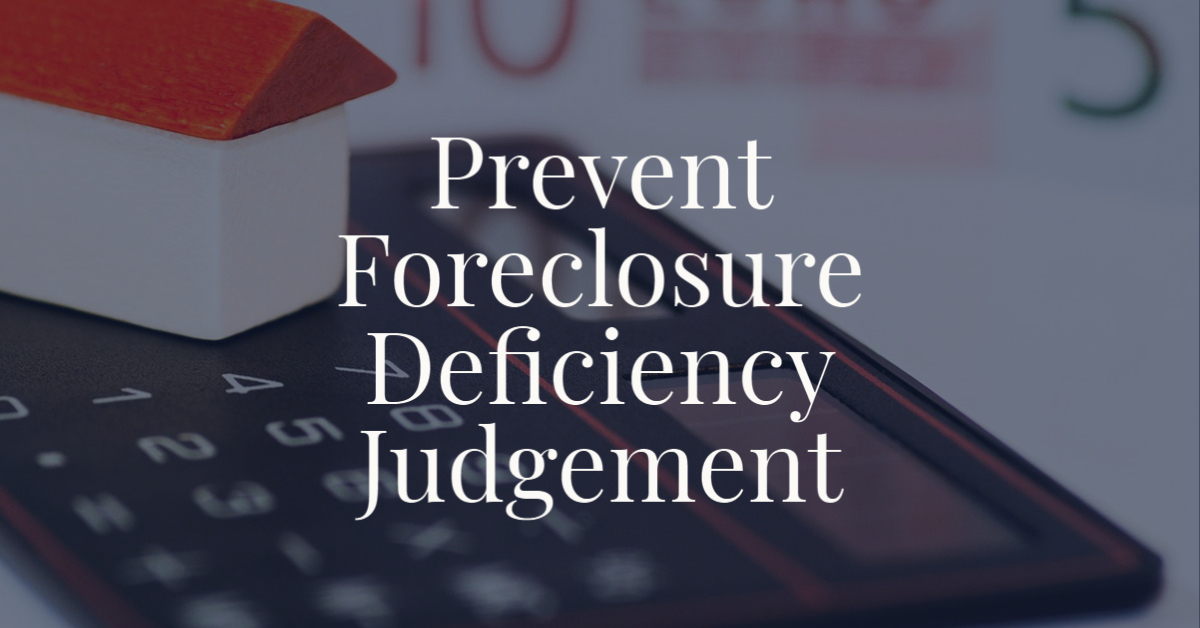

Up to 25% cash back negotiating with the lender to waive the deficiency judgment. Lenders don’t always act on a deficiency judgment. How to avoid a deficiency judgment.

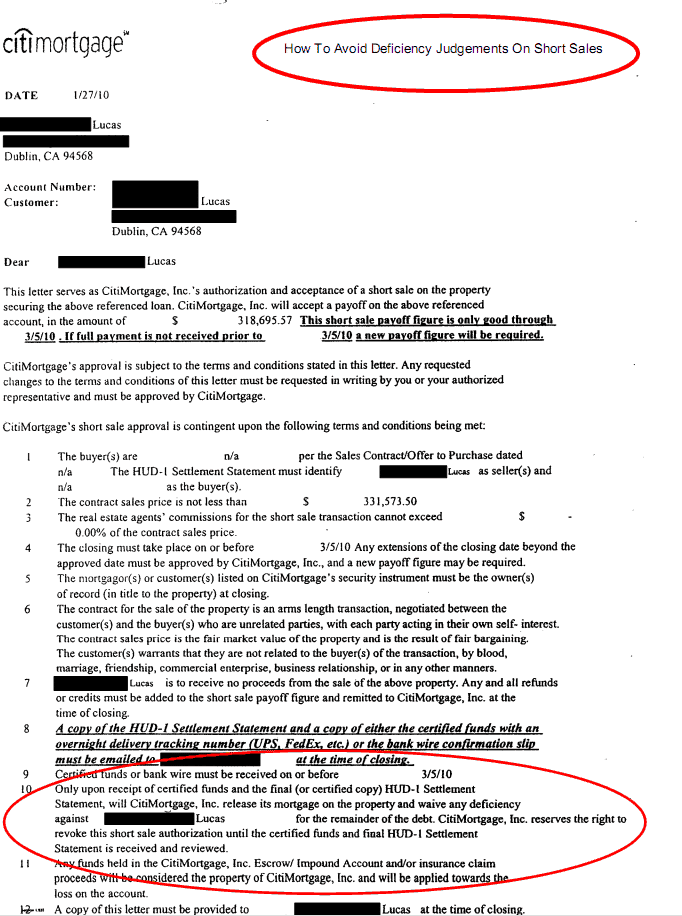

With a short sale, your lawyer can negotiate a deficiency judgment waiver. But there are some ways that a debtor can avoid paying a deficiency judgment: Avoiding deficiency judgments in foreclosure.

Some lenders will agree to waive the deficiency. If the lender can sue, then you have to wonder if they will sue. Wage garnishment occurs when an employer takes a portion of each of a borrower’s paychecks and sends it to the lender.

You'll also save your credit as a short sale may be reported as settled debt. There are strategic ways to avoid this type of judgment. Trying to pursue a short sale is often the best option for many faced with a foreclosure.

If you file for bankruptcy, you might be able to avoid paying. A good way to avoid a deficiency judgment is through a negotiated short sale. If you are facing foreclosure in florida , your best bet to avoid a deficiency judgment is with a short sale.